Attention Deficit Hyperactivity Disorder (ADHD) presents unique challenges that extend beyond the realm of focus and attention. For many individuals with ADHD, impulsive spending and budget overwhelm are common hurdles. In this blog, we'll explore the connection between ADHD and these financial challenges, along with practical strategies to regain control of your finances.

Understanding the ADHD-Impulse Spending Link

ADHD often involves impulsive behaviors, which can manifest in various aspects of life, including spending habits. Here's how the connection between ADHD and impulsive spending typically unfolds:

- Impulsivity: Impulsivity is a hallmark symptom of ADHD. Individuals with ADHD may struggle to resist immediate impulses, leading to unplanned purchases.

- Emotional Regulation: ADHD can also affect emotional regulation. Shopping may become a way to cope with stress, boredom, or emotions, leading to impulsive spending.

- Time Management: Challenges with time management can lead to procrastination in financial tasks, including budgeting, bill payment, and tracking expenses.

- Hyperfocus: On the flip side, some individuals with ADHD may experience hyperfocus on shopping or financial matters, leading to excessive spending on a single interest.

Budget Overwhelm in ADHD

Budgeting can be a daunting task for individuals with ADHD due to several factors:

- Organization Challenges: Maintaining organized financial records, tracking expenses, and managing bills can be overwhelming for those with ADHD.

- Detail-Oriented Tasks: Budgeting requires attention to detail, which can be difficult for individuals with ADHD who often struggle with focusing on minutiae.

- Inconsistent Income: ADHD may lead to inconsistent work patterns, making it challenging to maintain a stable income and budget.

Strategies to Tackle Impulsive Spending and Budget Overwhelm

- Set Clear Financial Goals:

- Establish specific, achievable financial goals to motivate yourself to stick to a budget.

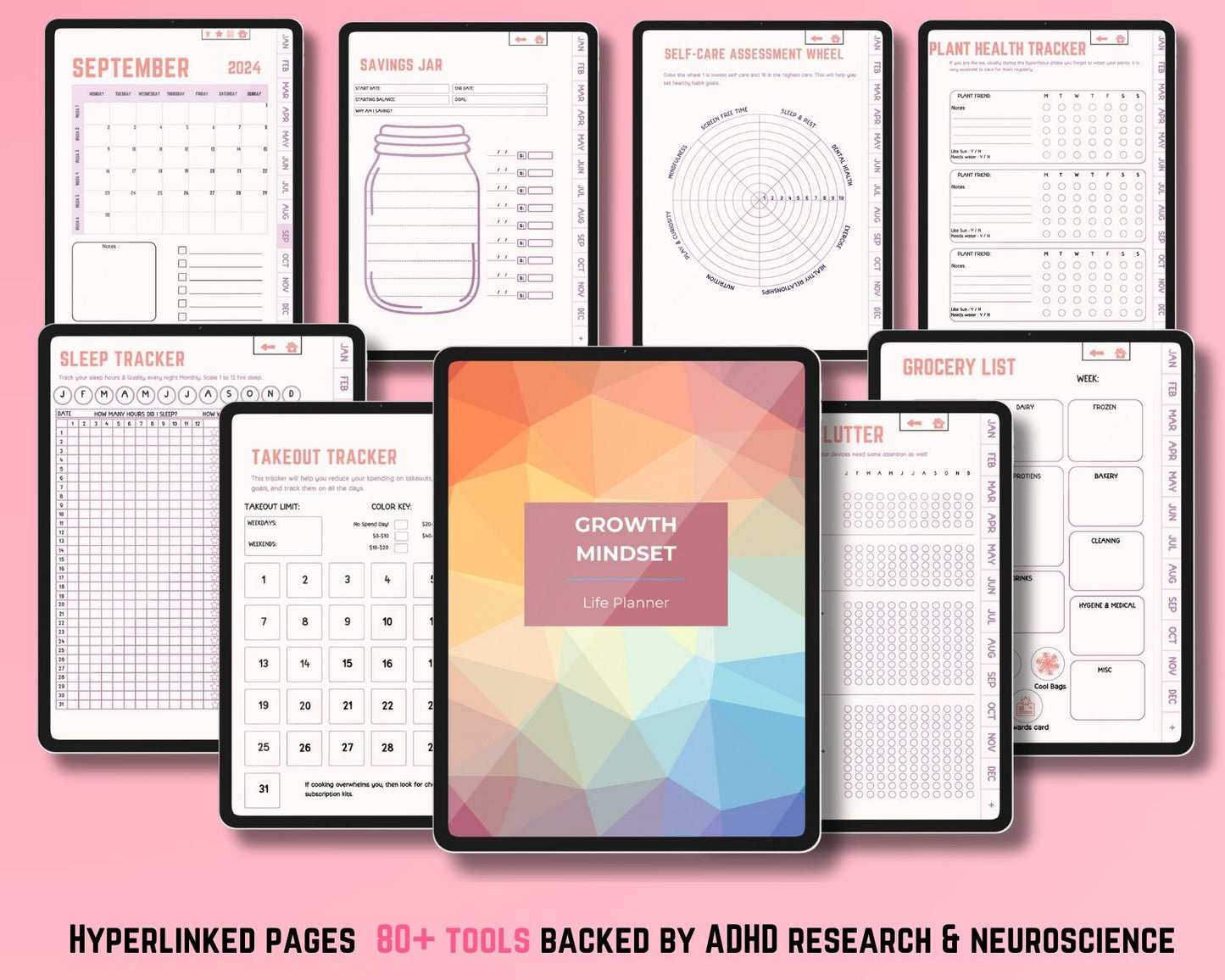

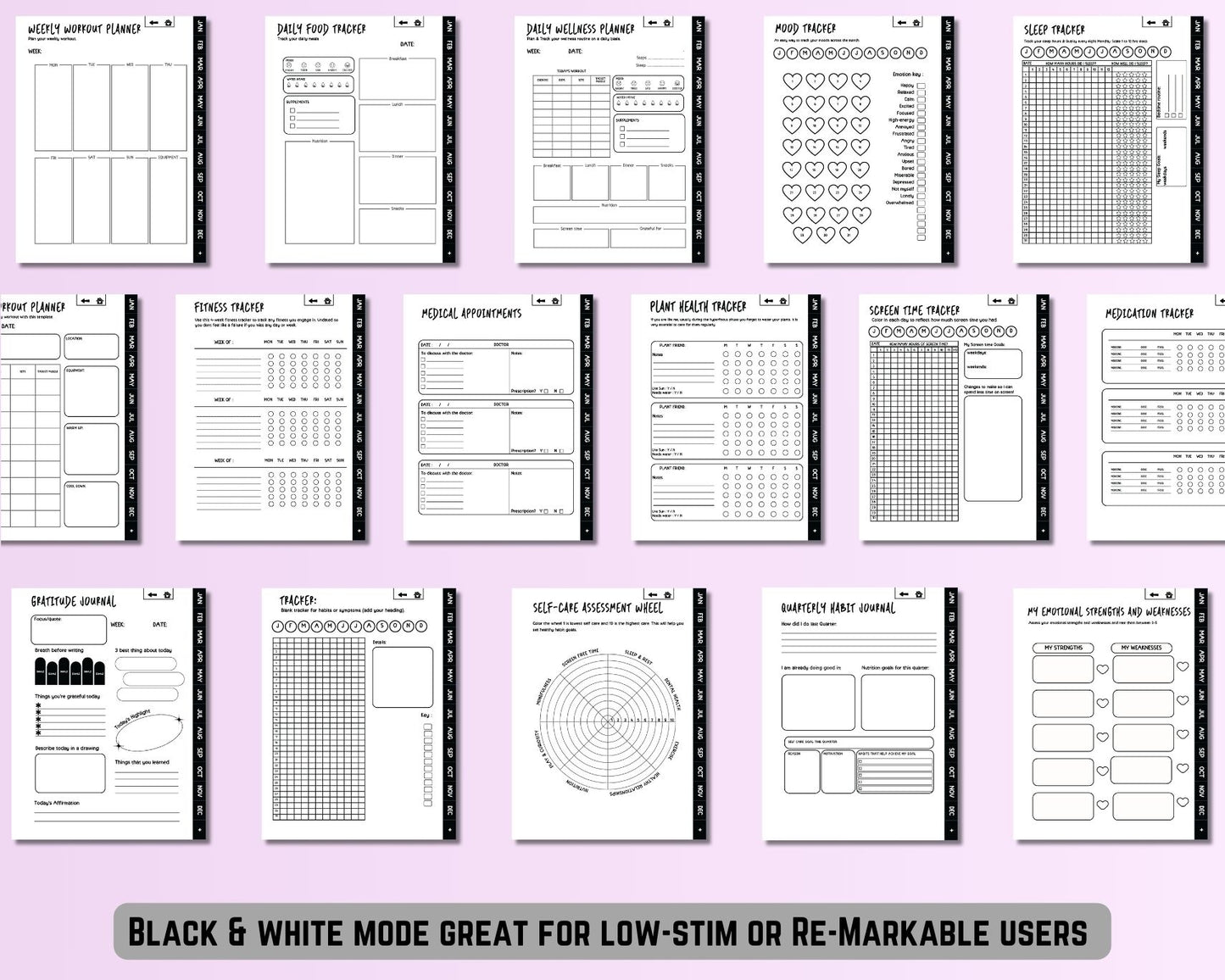

- Use Budgeting Apps:

- Utilize budgeting apps that automate expense tracking and provide visual insights into your spending patterns.

- Implement the 24-Hour Rule:

- Before making non-essential purchases, wait 24 hours to assess whether it's a genuine need or an impulsive desire.

- Enlist Accountability:

- Share your financial goals with a trusted friend or family member who can help keep you accountable.

- Practice Mindfulness:

- Engage in mindfulness exercises to become more aware of emotional triggers that lead to impulsive spending.

- Create a Budget Routine:

- Establish a consistent routine for budgeting, bill payment, and financial organization. Use alarms or reminders if necessary.

- Simplify Your Finances:

- Reduce the number of accounts and credit cards to minimize the complexity of financial management.

- Reward Yourself Sparingly:

- Allow yourself occasional small rewards for sticking to your budget, but set clear limits.

- Professional Financial Help:

- Consider working with a financial advisor or counselor who specializes in ADHD-related financial challenges.

Conclusion: Regaining Financial Control

Impulsive spending and budget overwhelm can be significant challenges for individuals with ADHD. However, with awareness, strategic planning, and consistent effort, it is possible to regain control over your finances. Remember that progress may take time, and setbacks are part of the journey. By applying these strategies and seeking professional support when needed, you can pave the way toward more stable financial management and peace of mind.